Complete Guide: How to Apply for the Asaan Karobar Business Card

Discover a comprehensive, easy-to-follow guide on how to apply for the CM Punjab Asaan Karobar Card Scheme. Learn about eligibility criteria, required documents, registration steps, and application procedures to access business loans and financial support in Punjab.

What is Asan Karobar Program?

The initiative provides interest-free loans of a maximum of PKR 1 million in a digital SME card. It is designed to provide assistance to small entrepreneurs in Punjab to expand and maintain their enterprises, ensuring well-structured through Digital Channels (e.g. Mobile App, POS etc.) and transparent expenditure of funds.

Essential Features of Asan Karobar

| Features | Details |

| Maximum Loan Limit | PKR 1 million |

| Tenure of Loan | 03 Years |

| Loan Type | Revolving credit facility for 12 months |

| Repayment Term | 24 Equal Monthly Installments after Year 1 |

| Grace Period | 3 Months after Card Issuance |

| Interest Rate | 0% (Interest-Free Loan) |

Permissible Usage of Loan:

| Allowed Transactions | Details |

| Vendor and Supplier Payments | To cover expenses for purchasing goods and services. |

| Utility Bills, Government Fees, and Taxes | Payments to government authorities and utility companies. |

| Cash Withdrawals | Up to 25% of the loan limit can be withdrawn for miscellaneous business needs. |

| Digital Transactions | Seamless payments using POS machines and mobile apps. |

Eligibility Criteria: Who Can Apply?

To be eligible for the Asan Karobar scheme, applicants must meet the following conditions:

Age : 21 to 57 Years.

Residency: Must be a resident of Punjab.

Business Location: Existing or planned business in Punjab.

CNIC and Mobile Number: Valid CNIC and mobile number in applicant’s name.

Credit History: Clean credit history with no overdue loans.

Credit & Psychometric Assessment: Satisfactory assessment results.

Application Limit : One application per individual or business.

Note:If you meet these criteria, you can proceed with the application.

Step-by-Step Application Process

| Step | Details |

| 1. Apply Online | Submit the application via PITB portal. |

| 2. Processing Fee | Pay a non-refundable processing fee of PKR 500. |

| 3. Verification | Digital verification of CNIC, creditworthiness, and business premises by authorized agencies. |

Step 1 - Access the official portal through Asan Karobar

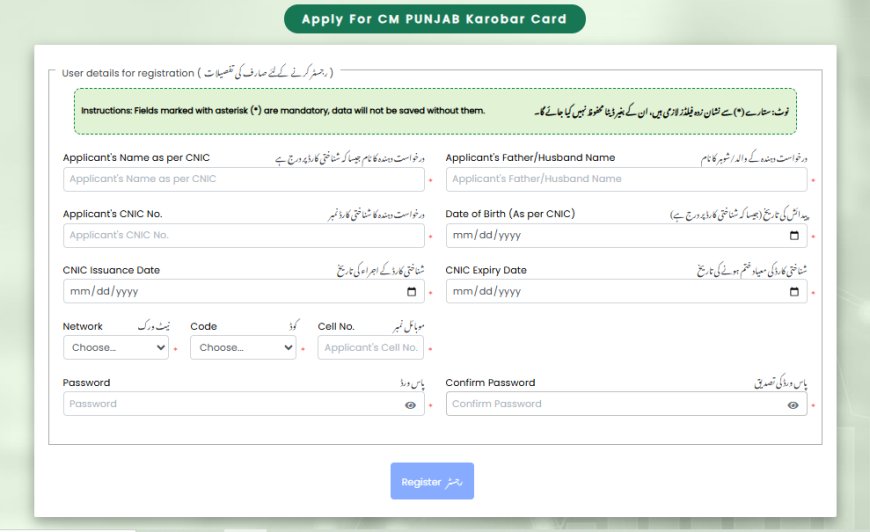

Step 2: Fill out the Registration Form

Enter Personal Details:

- Enter your full name according to your CNIC.

- Enter your CNIC number.

- Enter your date of birth (as stated on your CNIC).

- Enter your father's or husband's name.

- Enter the CNIC issue and expiry dates.

Enter Contact Details:

- Enter a valid mobile number and choose your mobile network.

- Make sure the mobile number is working for receiving confirmations and updates.

Create a Password:

- Enter a strong password for your account.

- Enter password again to verify, keeping both inputs the same.

Step 3: Fill out the Registration Form

Double-check all the details entered to make sure they are correct. After confirmation, click the "Register" button. On successful registration, you will be sent a confirmation message on your mobile phone.

Loan Usage and Repayment Structure

| First 50% Limit | Available for use within the first 6 months | |

| Grace Period | 3 months after card issuance. No repayments required during this period. | |

|

|

5% of the outstanding loan balance (principal only). | |

| Second 50% Limit | Released upon satisfactory usage, timely repayments, and PRA/FBR registration. | |

| EMI Structure | Remaining balance repaid over 2 years in Equal Monthly Installments (EMIs). |

Charges / Fees:

- Annual Card Fee: PKR 25,000 + FED to be recovered from obligor's approved limit

- Additional Charges: Life assurance, card issuance and delivery charges borne by the scheme

In the event of delayed payment of installments, late Payment Charges would be recovered according to Bank's Policy / Schedule of Charges

Security Details:

- Personal guarantee digitally signed by the borrower.

- Life assurance covered in the portfolio.

- Physical validation of business premises is done by Urban Unit within 6 months from loan sanction and once every year thereafter.

Key Conditions:

- Usage of funds for core business purposes only; non-business transactions are blocked

- PRA/FBR registration is required within six months from issuance of the card.

- Applications allowed only one per individual/business

Additional Support to Applicant:

- Feasibility Studies: Accessible on PSIC and BOP websites for new businesses and start-ups.

- Dedicated Helpline: For assistance, contact the helpline at 1786

Click Here To Apply : CM Punjab Asaan Karobar Card

What's Your Reaction?

Like

2

Like

2

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0