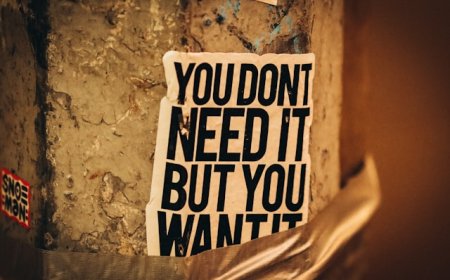

How Inflation Affects Daily Spending & Smart Ways to Reduce Its Impact

Discover how inflation impacts your everyday expenses and learn practical, smart strategies to minimize its effects. Make informed financial decisions to protect your budget.

People regularly here about the concept of inflation on the news, in political debates and in conversation at the grocery store. Inflation has a direct and measurable impact on your daily spending. Understanding and knowledge of inflation is crucial to manage your finances wisely.

Inflation is defined as the rate at which the general level of prices for goods and services rises causing the purchasing power of money to decline of a time. For example if the inflation rate is 5% a basket of goods that costs $100 this year will cost $105 next year. A low and steady rate of inflation is normal. High or unpredictable inflation can create financial burden on consumers.

The most noticeable effect of inflation is at the gross restore. Due to inflation consumers find that their weekly grocery bills increase even if their buying the same items. Bread, milk, eggs, meat and vegetables are particularly sensitive to inflation. As a result people switch to cheaper alternatives, reduce quantity or cut certain items altogether.

Fuel prices are often among the first areas where inflation is felt. These increased prices not only affect the individuals but also the public transportation, shipping and logistics. It also results in an increase in rent and home prices. This means a large portion of renter's income goes toward housing. Property taxes and maintenance costs often rise with inflation.

Electricity, water and heating costs also rise with inflation. Similarly services like the internet, cell phone and subscriptions increase their rates annually. These increments may seem small but they add up over time and tighten the household budget. Here are some practical tips to cope with inflation:

1. Review your budget regularly and identify areas where you can cut back

2. Buying in bulk can help you lock in current prices and save time

3. Finding ways to increase your income will help offset rising costs

Inflation does not always show higher prices. Manufacturers sometimes use the technique shrinkflation. It means to reduce the size or quantity of a product while keeping the price same. It is impossible to completely avoid the effects of inflation. Being productive allows you to make smarter financial choices.

What's Your Reaction?

Like

11

Like

11

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

1

Wow

1