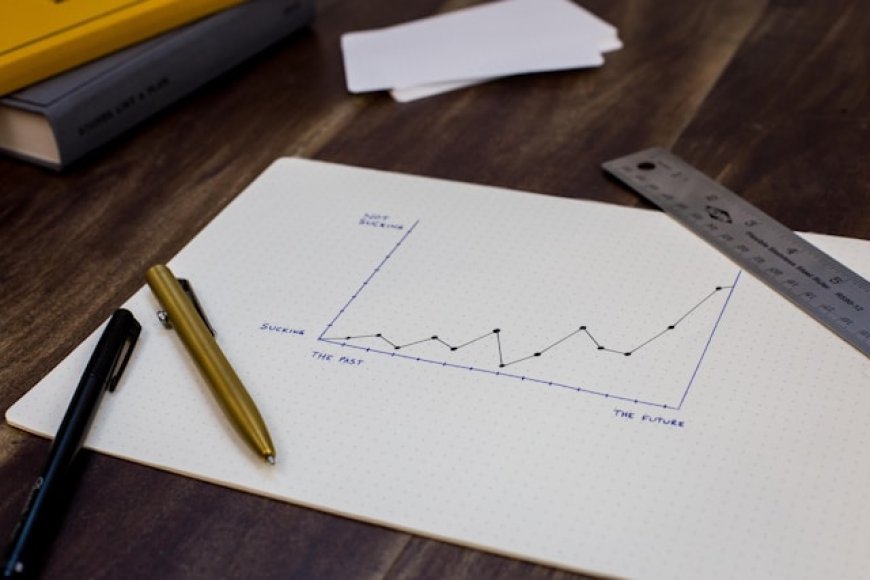

Set & Achieve Financial Goals | Track & Adjust Effectively

Learn how to set realistic financial goals, track your progress, and adjust your strategy to achieve financial success. Expert tips for smart money management.

Financial success is about how effectively you manage, plan and work towards your goals. Financial goal is the foundation of financial health whether you dream of buying a home, eliminating debt or saving for the education of your children.

Financial goals matter because they provide direction and purpose to your money. Financial goals help you to prioritize your spending, avoid unnecessary debt, and reduce financial stress. Checking your financial goals is necessary. Monthly reviews can help you to see whether you are on track, identify problem areas, celebrate small wins and adjust your goals based on life changes.

You may have several financial goals at the same time but you should prioritize your goals to tackle them more effectively. Categorize your goals into:

1. Short Term Goals

2. Mid Term Goals

3. Long Term Goals

Life is uncertain. Some changes can affect your goals like economic shift, emergencies or changes in your personal life. Therefore it is important to be kind to yourself if you fall behind. Revisit your goals and allocate funds if essential. Stay flexible and adjust your goals when needed. It does not mean give up but remain realistic with your goals.

Staying motivated is the key to achieve your goals. During this journey to keep yourself motivated you can break your larger goals into smaller ones to celebrate your progress. Even online groups on investing and saving money can offer encouragement and tips. If you share your goal with your sincere friend it will increase accountability.

First you need to understand where you stand financially before setting realistic goals. You can use budgeting apps, spreadsheets or paper documents to track your income and expenses. List all outstanding debts including interest rates and minimum payments. This will help you to determine what goals are feasible and what adjustments might be needed.

Setting and achieving these goals will help you to create the life you want. It requires discipline, determination and planning. Review your goals monthly or after certain period of time to keep yourself on track. Stay committed and check your progress regularly. Consistency is the key to get financial freedom.

What's Your Reaction?

Like

9

Like

9

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0