50/30/20 Budget Rule: Beginner’s Guide & Top Benefits

Discover the 50/30/20 budgeting rule, how it works, and why it’s great for financial planning. Learn how to manage needs, wants, and savings effectively.

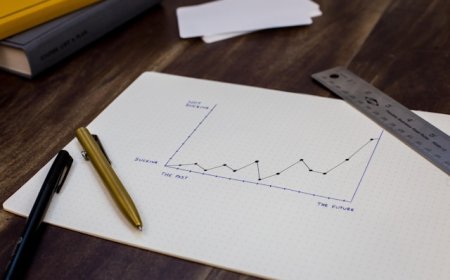

There is a simple and effective method that can help every person to control their finances. There is 50 /30/ 20 rule. This strategy helps to manage money, reduce financial stress and work towards the financial goals. In this article you will learn 50/30/20 rule, how it works and how you can apply to your everyday life. It is a budgeting method that divides your income into three categories:

1. 50% for needs

2. 30% for wants

3. 20% for savings

50% of your income should be used for necessary expenses. These are essential for daily living and survival. These include rent, utilities, groceries, transportation, insurance, loan payment and child care. If your expenses are taking more than 50% of your income then you need to find ways to cut the costs. You can downsize your home, use public transportation and find cheaper insurance plans.

You should use 30% on your wants. Wants are the things that you enjoy but are not essential. These include dining out, travel, vacations, subscription services, hobbies, entertainment, shopping for clothes and gadgets. In this category most people overspend because often wants and needs are confusing.

For example a car is a need but luxury vehicle with premium features will fall into the category of want.

20% of your income must be used for savings. This saving category will help you secure your financial future.

This category includes emergency fund contributions, retirement savings, extra debt payments, investments, saving for goals like buying home and education. This will bring financial satisfaction and progress towards long term goals.

This rule is very simple and does not require spreadsheets or complex financial formulas. It is a high level framework that is easy to follow and adjust over time. It gives you a clear picture of where your money goes. It balances the current lifestyle, needs and secures your future. This is more than just a budgeting formula. For beginners it offers a low stress way to begin, managing your money and creating a financial plan.

What's Your Reaction?

Like

9

Like

9

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0