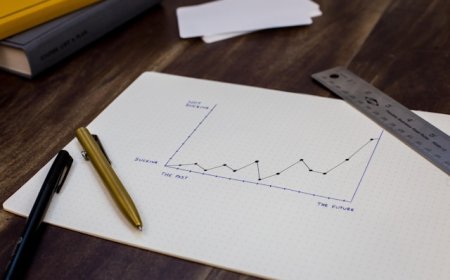

Living on a Low Income: Smart & Creative Ways to Stretch Every Rupee

Learn how to manage your budget and stretch every rupee with practical tips for low-income living. Discover smart saving hacks, budget-friendly meals, and creative money-saving strategies for daily life.

Managing life on a low income can be difficult in a world where the cost of living seems to rise constantly. Budgeting is a survival skill for many individuals and families. Living with limited financial resources does not mean to compromise on health and happiness. You can stretch every rupee with creativity, discipline and strategic thinking. Every rupee saved today is an investment in your tomorrow.

Awareness is the first step toward financial control. Many people get surprised when they come to know how everyday expenses drain their wallets. Some apps like Money Manager, Walnut or even a simple notebook can help you to categorize spending. In this way, you can identify non-essential areas where you can cut back. Smart money habits are your strongest ally.

Living on a low income demands clear priorities. You should know the difference betweem necessities and desires. This does not mean completely skipping the joy but it means planning for it wisely. You must think clearly before spending. For this purpose, you can create a wish list instead of impulse buying. It will result in satisfaction and low cost.

Food is often one of the largest monthly expenses. You can save significantly if you want. Cooking at home is not only cheaper but often healthier than eating out. You should plan meals for the week to avoid takeout. Buying staples like rice, lentils, flour and seasonal vegetables in bulk can save money. Learn to make nutritious and simple meals like khichdi, sabzi-roti or dal-chawal.

Local grocers and street vendors offer better prices than supermarkets. Always compare prices before buying. Never shy away from bargaining in local markets. Avoid branded products when local alternatives offer the same quality at a lower price. Transport costs can eat into your budget. Use public buses, metro systems or shared auto-rickshaws. Develop habit of saving. Use a separate envelope or savings account for this purpose.

What's Your Reaction?

Like

6

Like

6

Dislike

0

Dislike

0

Love

1

Love

1

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

1

Wow

1