How to Build an Emergency Fund on a Low Income | Smart Saving Tips

Struggling with low income? Discover practical and proven strategies to build an emergency fund, save money, and gain financial security—even on a tight budget.

An emergency fund provides the safety net when life throws unexpected expenses. It is one of the most important components of financial stability. Unexpected expenses include medical emergencies, car repairs, job loss or urgent home maintenance. This idea of saving money is very helpful for the people living on a low income.

It is important to understand an emergency fund before taking any action. Without understanding this any financial emergency can lead to debt, stress or reliance on high interest loans. Even a small amount of emergency fund will help you to gain peace of mind and the ability to handle unexpected situations.

Analyze your spending and remove money wasting habits and track where your money goes. No matter how much is your income level you will find areas where you can cut back your expenditure. These may include:

1. Rarely used subscriptions

2. Eating out or take-out meals

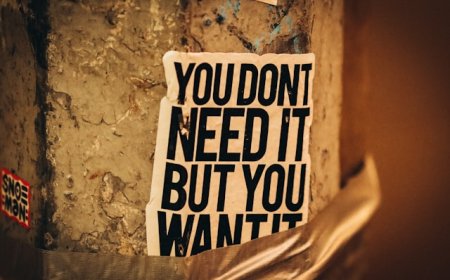

3. Unused gym membership and impulse purchases

When you have tracked your spending and identified the areas of expenses then you can cut extra purchases. You don't need to sacrifice all of your joy but be intentional with your spending. You must adopt these cost saving strategies:

1. Cook your meal at home

2. Make a list of essential items to avoid impulse buys

3. Use cash back apps

4. Find free entertainment options in your area

5. Conserve energy and lower your utility bills

If your current income is low and you cannot save then you should try an additional source of income. Even a few hours a week can make a big difference. Additional income sources may include freelancing, gig work, selling items online, pet sitting and tutoring. For saving money saving account is a better option. Avoid keeping money in your checking account where you are tempted to spend it.

Saving money is easier when you have support. You can share your goals with trusted friend or family members who can keep you accountable. You can also join online community where people share tips and encourage savings. You need commitment and small steady steps. Having an emergency fund means having one less thing to worry about when life takes an unexpected turn. It is your peace of mind and your first step towards financial independence.

What's Your Reaction?

Like

9

Like

9

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0