How Gen Z Is Transforming Money Mindsets

Explore how Gen Z is reshaping financial habits worldwide. Discover their unique approach to money management, saving, investing, digital banking, and redefining financial independence.

In the past, managing money meant saving up for a house and contribution to a retirement fund. Gen Z is the generation born between the late 1990s and early 2010s. It is rewriting the rules of personal finance. Inspired by the digital revolution and economic uncertainty Gen Z is changing how society views earning, saving, investing and spending. Their approach is more values driven and entrepreneurially than any generation before them.

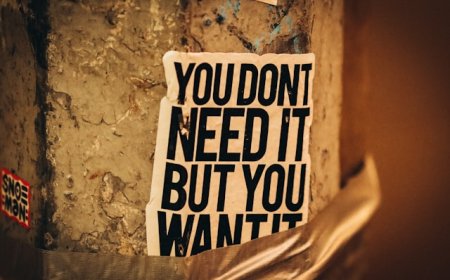

Unlike previous generations, Gen Z wants their dollars to align with their values. This generation is willing to spend money based on their beliefs. According to 2023 survey about 73% of Gen Z consider a company’s environmental and social impact before making a purchase. This preference for conscious consumerism extends to investing. The rise of funds and impact investing shows how Gen Z is influencing even Wall Street.

The traditional career path was going to college, get a job and retire at the age of 65. This does not hold the same appeal for Gen Z. Young people today have access to diverse income streams through the internet and social media. They are earning via freelancing, dropshipping, influencer marketing, online tutoring, content creation, crypto trading, and more. According to a 2024 report by Upwork, 53% of Gen Z workers are freelancers. Platforms like TikTok, Fiverr and Shopify have made easier for Gen Z to monetize their skills and passions.

Gen Z is learning on their own terms like budgeting tips, investing strategies or debt management advice. This availability of financial education is powerful. It gives young people access to knowledge that was previously locked behind professionals and academic institutions. Gen Z is changing how we define success. It is no longer just about the car, the house or the corner office. For many success means doing meaningful work, maintaining work life balance, being debt free and having the freedom to travel or enjoy life.

What's Your Reaction?

Like

6

Like

6

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0