The Decline of Cash: Are We Ready for a Cashless Global Economy?

Explore the decline of cash worldwide, the rise of digital payments, and what a fully cashless global economy means for security, privacy, and financial inclusion.

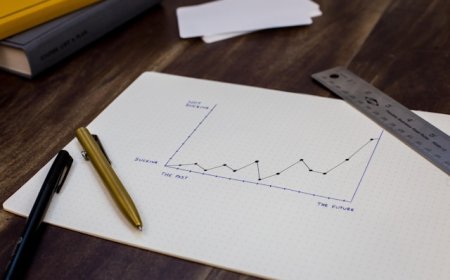

The coins and paper money have been the lifeblood of human commerce for centuries. The cash has been central to trade, culture and trust. However, in the 21st century, the dominance of physical currency is waning. Digital payments, mobile wallets and cryptocurrencies are challenging the relevance of cash. The shift away from cash has accelerated over the last two decades. In many advanced economies, cash payments are shrinking year by year. According to the Bank for International Settlements, the use of cash in daily transactions has dropped by more than 50% across much of Europe, the United States, and parts of Asia.

The COVID-19 pandemic further fueled this trend. Concerns over hygiene, combined with the rise of online shopping and contactless payments, pushed more people toward digital alternatives. In 2020 alone, global digital payments grew by nearly 25% while ATM withdrawals plummeted. This momentum has carried forward, making the cashless society. Digital payments are faster and easier. Instead of fumbling for coins or worrying about exact change, consumers can complete a transaction with a tap or scan. Businesses also save time counting, storing and transporting cash.

Cash is anonymous and untraceable. These are the qualities that make it attractive to criminals. A cashless economy reduces the risk of physical robbery. Even if a card or phone is stolen, digital accounts can be frozen, unlike cash which is irretrievably lost once stolen. Digital transactions leave a record by making it harder to hide money. Governments benefit from improved tax collection and reduced shadow economies which could translate into more equitable public services.

Elderly people, rural communities and those without access to smartphones or the internet risk are being excluded. For many, cash is still the only reliable way to transact. Digital systems are vulnerable to hacking, outages and surveillance. Rather than eliminating cash entirely, a hybrid approach may be the most practical path forward. Maintaining physical currency alongside digital systems ensures resilience, inclusivity and choice. Policymakers must strike a balance between embracing innovation and protecting vulnerable groups.

What's Your Reaction?

Like

5

Like

5

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0